ATLANTA — The Social Security Administration is demanding a Georgia woman should have to pay for a government mistake the agency made more than four decades ago.

Channel 2 Action News has learned that the SSA is using an obscure law to go after decades-old debts its says its owed.

Channel 2 Investigative Reporter Justin Gray said that what makes the case so strange is that the government is going after people who did not even get the money in the first place.

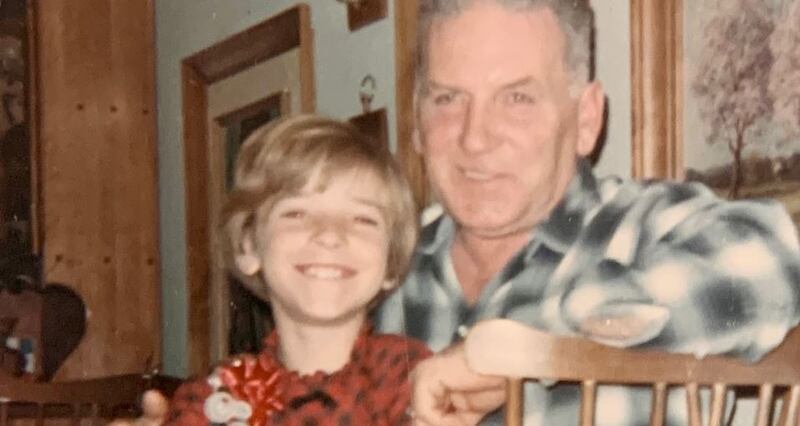

Ginger Snowden was just 14 years old back in the 1970s when the SSA now says it mistakenly overpaid her father social security benefits.

Now, long after his death, the federal government wants her to pay back the money.

Federal officials are standing by the claim, telling Gray that they have a legal right to demand payment.

Snowden said she thought the letters were a scam, that there was no way the real SSA was reaching out to her about overpayment when she's never drawn a social security check.

“We kept asking, but wait, why?‘” Snowden said. “Neither one of us collects social security. I don’t understand.”

It took months for the Tyrone, Georgia couple to finally find out the letters were real and what the debt was.

The alleged overpayments to Snowden's father -- nearly $3,000 -- were from 1973 when she was still a child.

"It was like, 'How can you collect money from me?'" Snowden said. "I just kept saying over and over again that I was 14 years old."

According to officials, Snowden lived in the same house with her father at the time, and therefore received some benefit from the money.

The Snowdens are not alone.

After they called the Clark Howard Consumer Action Center, Channel 2 Action News started an investigation.

"I've seen this kind of egregious behavior all the time," Boston University professor Laurence Kotlikoff said. "Every couple months, it comes up."

Kotlikoff said he has been tracing incidents like this for several years.

“This is ongoing practice by social security,” Kotlikoff said. “And if you want to try to get this adjudicated, it’s a nightmare.

The same thing happened to 6-year-old Dylan LeCour. LeCour, who is now 8, lost his mother to a drunk driver in 2017. His cousin Erin moved him into her Woodstock home and adopted him.

His father is unable to care for him, but sends part of his Social Security disability money, and Social Security also provided a small monthly payment from his deceased mother's benefits, which was only a little over $100 a month.

"I couldn't believe they were trying to take money from this little boy," Erin LeCour said.

About a year later, the Social Security Administration demanded $2,000 from LeCour, saying they should not have been paying him benefits from both parents.

"He has nothing whatsoever, and you are trying to take nothing from this little boy who lost his mother?" Erin LeCour said. "How can you do that? Why would you want to do that?"

Erin LeCour fought the Social Security Administration and won.

"You can't expect a 6-year-old boy to pay back money," Erin Lecour said. "A 6-year-old doesn't have a job."

The Snowdens, on the other hand, have had repeated appeals rejected, and continue to get past due notices threatening to garnish their tax refunds or future social security checks.

“We kind of have been ignoring their letters up to this point, but the bottom line is, we’re both getting close to collecting Social Security,” Snowden said. " We know whats going to happen. They are going to take it out of our check.”

So why is this happening? It goes back to the 2008 Farm Bill.

Along with all the provisions relating to agriculture, a rider was added eliminating the statute of limitations for collecting old debts.

Back in 2014, Senator Chuck Grassley sent a letter blasting the Social Security Administration for going after decades-old overpayments, writing, "The actions raise serious questions about whether it is collecting debt properly or fairly."

After the criticism, the Social Security Administration temporarily stopped those controversial collection efforts.

But now, the SSA tells Gray: "Our review found we correctly applied the law and our regulations, policies and procedures.

In 2018, they say the once again started attempting to collect the old debts.

Social Security officials told Gray they change d the policy and have stopped referring debts over 10 years old to the IRS for collection.

But they are still sending the Snowdens bills.

“You just expect someone somewhere to recognize the ridiculousness of the situation,” Snowden said. “We keep hoping that someone will step and realize. But it just isn’t happening. I just don’t want it to happen to someone else.”

Gray learned when the federal government got some criticism for this a few years back, they temporarily stopped doing it, but now they’ve started again.

Cox Media Group